Call us now:

The registered taxpayer shall provide the details of the purchase and sales of the business in the Inland Revenue Department as per schedule 10 of the Act. Details should be submitted monthly or quarterly according to the registration type (compulsory or voluntary) and it must be submitted to the Inland Revenue Department within 25 days of the expiry of the tax period. The taxpayer of the district who does not have an Inland Revenue Department office in the district can submit to the district treasury controller office.

Registration is compulsory and voluntary should be submitted at the time given below;

*TrimesterlyTrimester (Quarterly)

- From Shrawan to Kartik should be filed within 25th Mangsir.

- From Mangsir to Falgun should be filed within 25th Chaitra.

- From Chaitra to Ashad should be filed within 25th

*Monthly

- It should be submitted in one-month details

- It should be submitted every 25th of next month.

- Example: The details of the month of Shrawan should be submitted to 25thbhadra

Note: As per the current practice of IRD, new taxpayers are mostly registered in a monthly filing system.

Procedure for VAT Return filling.

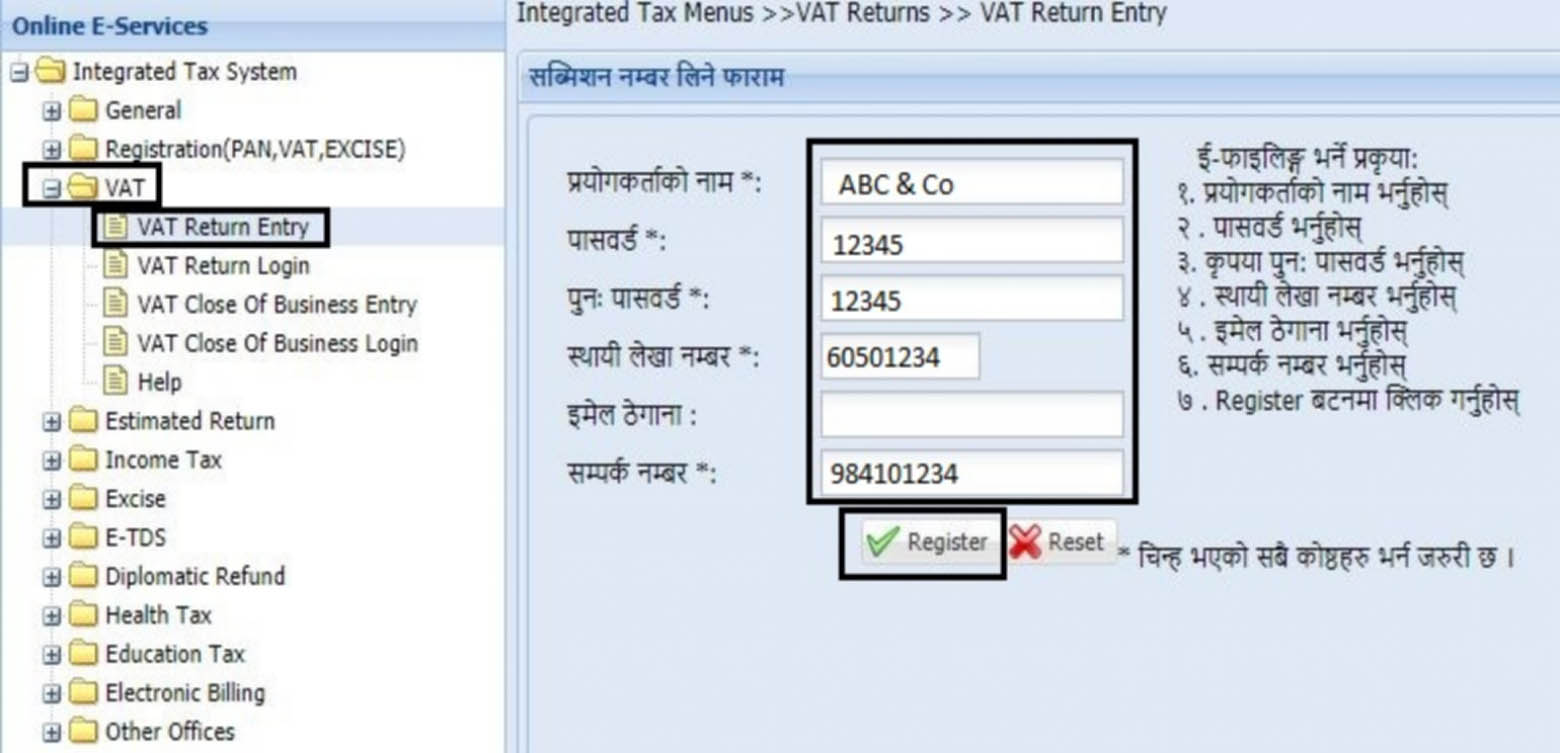

- Log in to ird.gov.np

- Click on the taxpayer portal on the home page

- Then click on VAT in the menu

- Then click on VAT return entry

- Boxes Asking for information related to PAN, Username, password will appear fill in the details & click on register

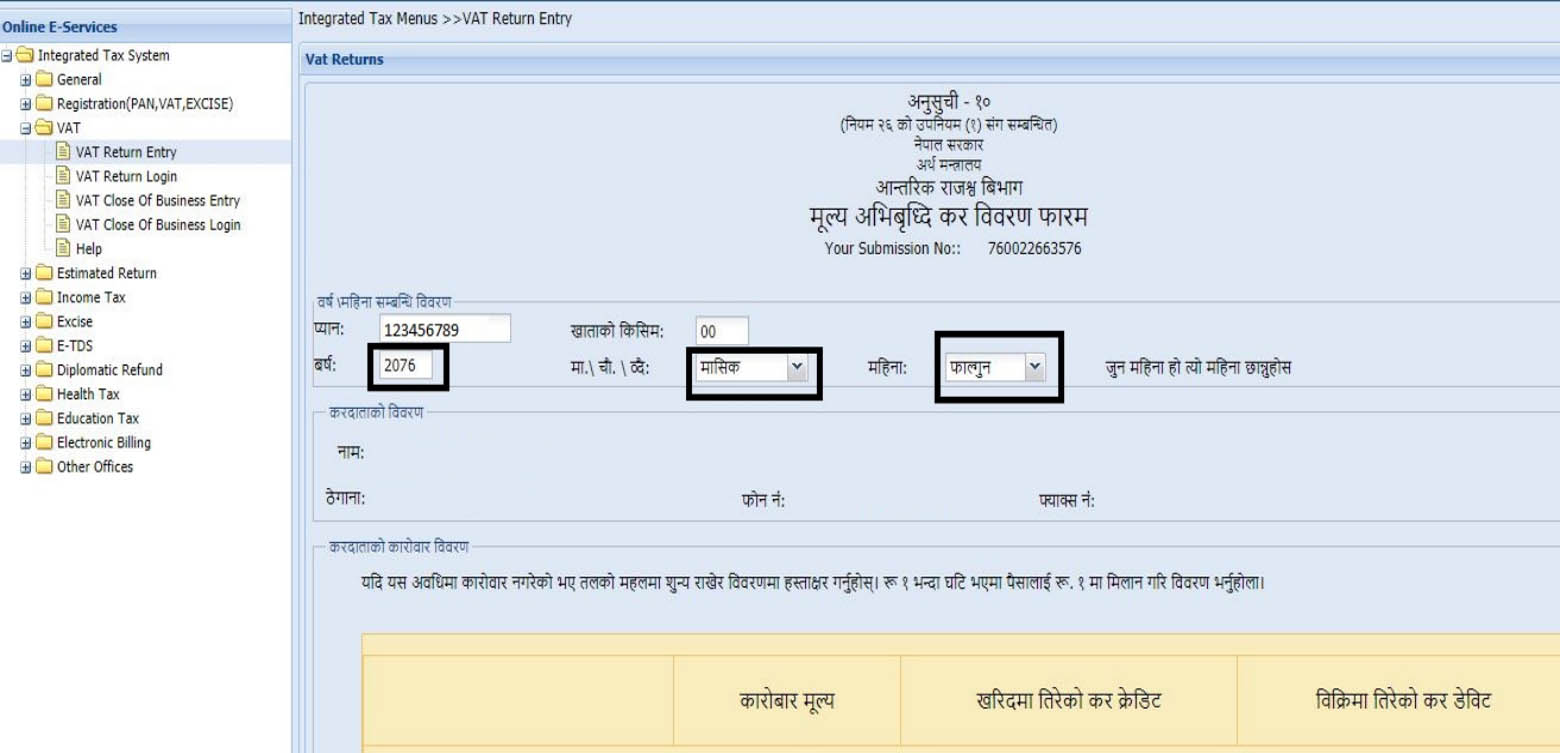

- After registration new page will appear giving Submission number save the submission number & Click on the proceed option.

- A new page asking multiple questions will appear fill in the page one by one starting with FY, Monthly/Quarterly/six-monthly & the month of which the return is filed.

- Before filing this return we should calculate the total amount of purchases, sales, imports and exports so that the return can be filed easily.

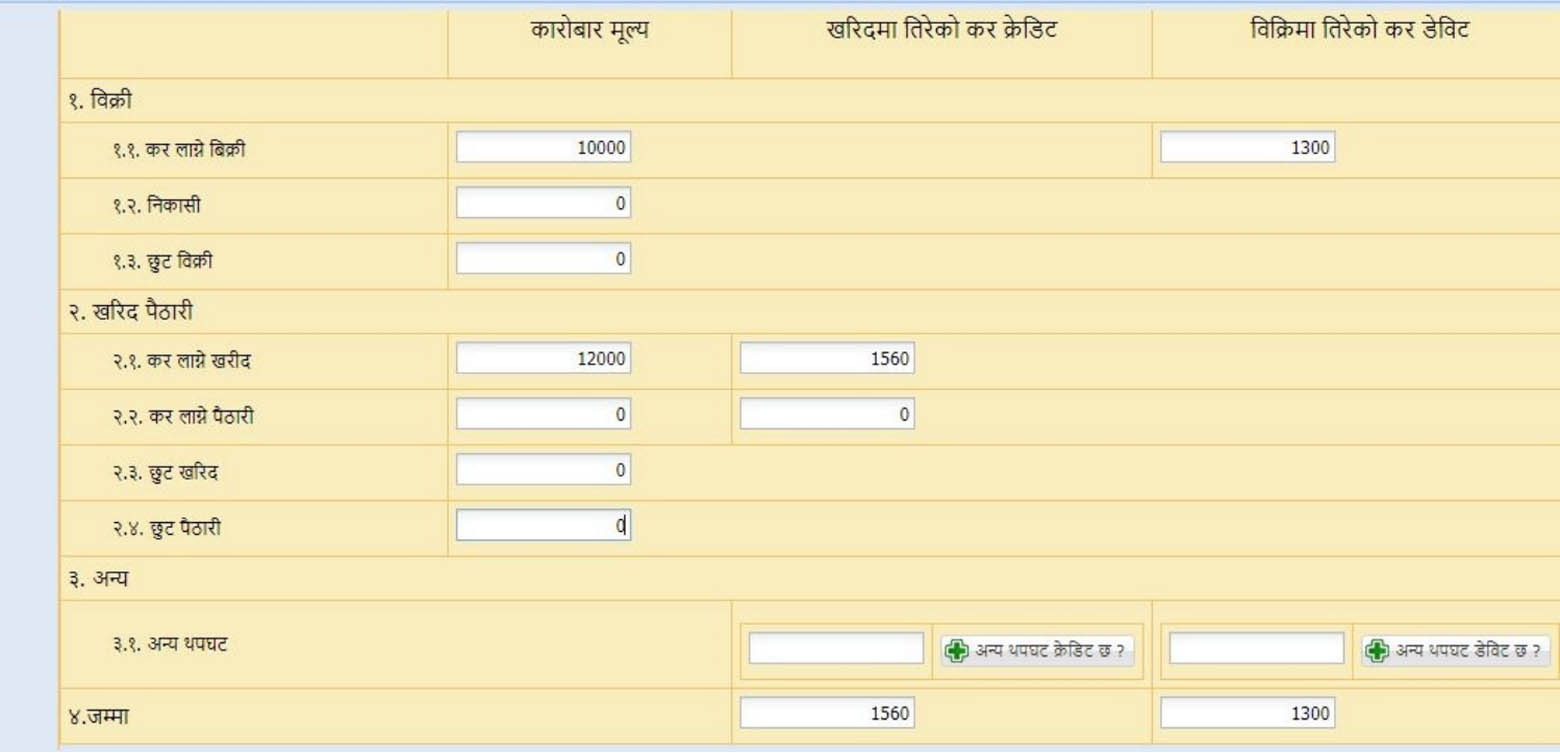

- Scroll below the page and fill in all the details asked such as:

Sales Details- Taxable Sales & VAT on sales

- Export Sales ( If any )

- Tax exempted Sales ( If any )

Purchase Details

- Taxable purchase & VAT on Purchase

- Taxable Import & VAT on import ( If any )

- Non Taxable purchase ( If any )

- Non Taxable Import ( If any )

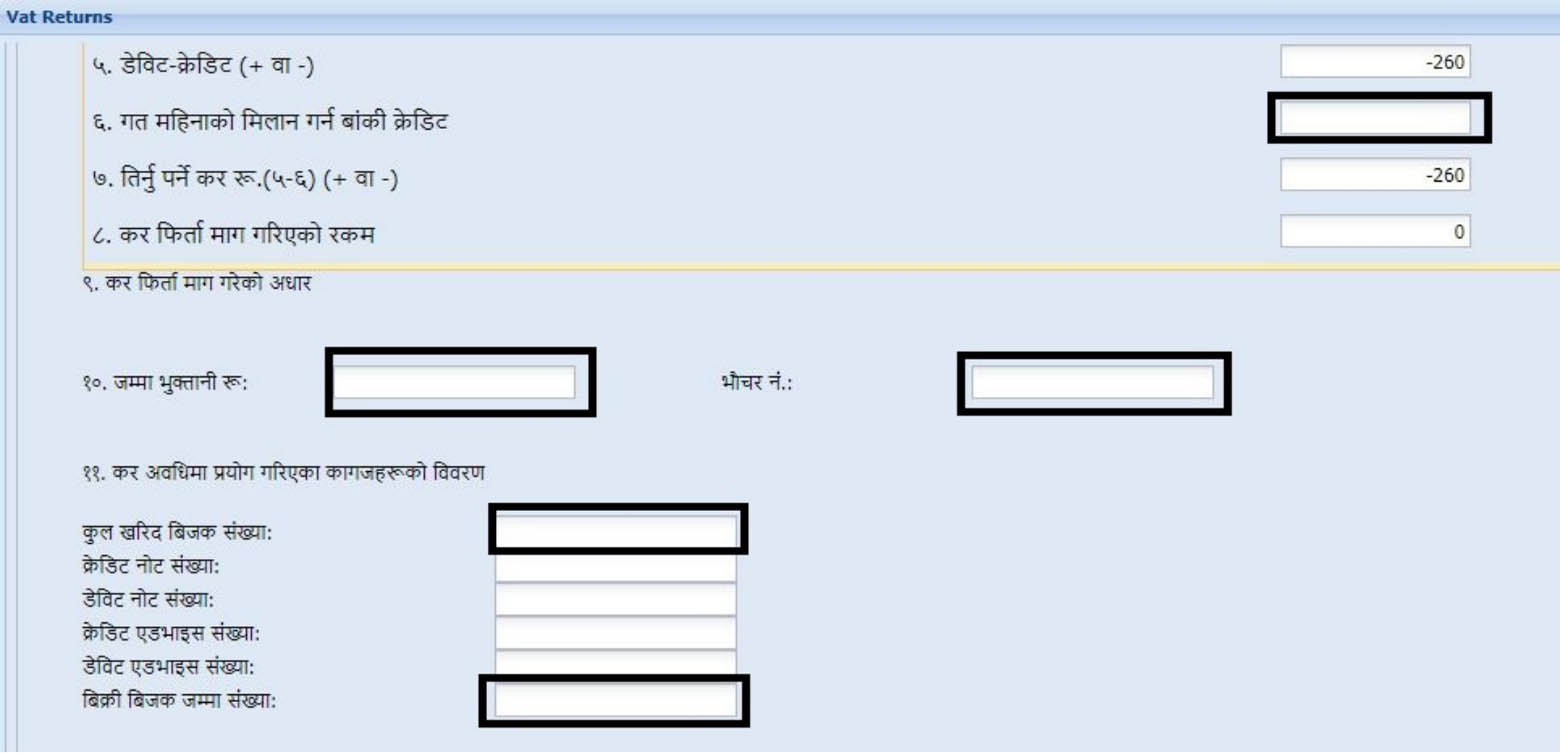

- After filling in all the details check the total amount of VAT payable /receivable

- There is an option below the total taxable amount as “last year’s credit”. If we have last year’s credit, fill the box with the credit amount after that if VAT payable comes then we should pay the same amount to the tax office if receivable/credit balance comes then we don’t have to pay the amount, balance credit will be transfer to next month.

**Note: Credit amount means “Excess Amount of VAT paid Till Last month”

- If VAT has to be paid for the month then after paying the VAT amount Voucher Number & VAT Paid amount should be shown on the box asked.

- After that next step is to fill several Sales bills & purchase bills.

- At last, after filling in all the details, click on the box next to “I will verify that the information mentioned in this tax statement is true” at the end of the Page.

- Then Press save below

- Then press submit and click Verify

- Fill in the page PAN number and password and if there is a due amount between months then add it and click ok, a new box saying Verified Successfully.

*IMPORTANT NOTE*

- For auto verification, the taxpayer should take a General login username & Password from the tax office.

- If the detail of VAT submission is filled in at a date later than the prescribed date then a penalty of 0.05% of the tax amount or Rs.1000 per month whichever is higher along with the return.